Matches(fashion) and the Case for AI

I have been reflecting on the recent news that Matchesfashion (Matches) is going into Administration. This is terribly sad news. I knew some of the team personally and my thoughts are with them.

This article will consider whether AI could have improved Matches’ revenue and profitability and saved it from going into administration?

Blog contents:

Matches - a Personalisation Story (something alcoholic for the waiting husband)

The Rise and Fall of Matches (industry and macro-economic challenges)

Matches’ Business Model and the case for AI

Value Creation (AI) Levers

Could Matches have ‘gone big’ on AI in 2017?

Would Matches have needed an AI-Transformation?

Matches - a Personalisation Story (something alcoholic for the waiting husband)

When was the last time you bought an £1800 t-shirt? It’s not for me. Perhaps I am just lucky that my favourite brand sells them for £5 and throws in a collar for good measure.

Fortunately for luxury brands and retailers there are many people with fatter wallets and a far greater fashion sense than me. So many in fact that Matches had a peak valuation of $1bn when Private Equity invested in 2017.

30 years prior, as The Iron Lady was busy crushing Neil Kinnock, Tom and Ruth Chapman were busy setting up the first store in Wimbledon Village. No doubt inconceivable to them at that moment that the empire would grow into an e-commerce platform shipping to 200 countries. The Times perfectly captures the nostalgia of these halcyon days. The clue is in the name. The better you know your customer, the more sophisticated you will be in aligning their preferences to the latest fashion.

“It was a special place from the early days,” a former employee remembers. “A glass of wine or beer for the waiting husband, toys for the kids while parents shopped. VIPs came to the store for the fashion but also the experience and the discretion.”

Personalisation is Matches’ raison d'etre and how they started out in Wimbledon. When they launched their website in 2006 the growth challenge was to take this core competency into the digital world. Fast forward to today and it is a very obvious application of data science and table stakes given that brands are fighting back with direct to consumer (DTC). It appears even back in 2019 Matches were making good progress in recommendation engines. There is an amusing difference between the alleged sophistication of recommendation models versus the daily frustrations we seem to face as consumers. The below comment about Matchesfashion, taken from a mainstream newspaper just the other day, seems to indicate that I am not alone in my thinking. Your recommendation engine is only as good as the channel execution allows it to be.

The Rise and Fall of Matches (industry and macro-economic challenges)

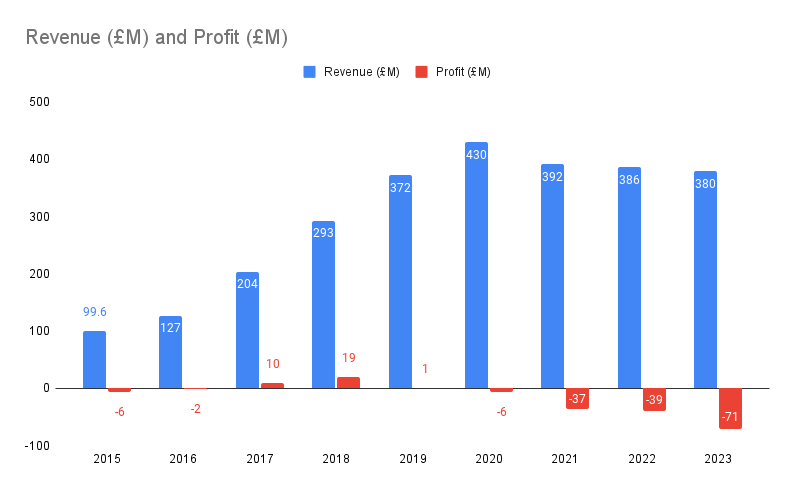

Looking at the 2015-2023 revenue and profit (see chart below) pre and post Private Equity investment (2017), notably we see a growing and profitable business in 2017-2018.

Matchesfashion 2015-23 Revenue and Profit figures (Source: Companies House)

Major Inventory issues - Notably, gross profit margin (FY19 vs FY20) dropped from 37% to 31% due to Cost of Goods Sold (COGS) showing as £270m each year. Digging deeper, (and noting COGS = Opening Inventory + Purchases During the Period - Closing Inventory) we see that Matches entered 2020 with already high levels of inventory. Old stock was marked down and some was written off (inventory provision increased by £10m going from 2% of gross value of inventory to 16%). COVID and Brexit related supply chain disruption also compressed full-price selling windows. All of this hurt profitability.

Changes in customer behaviour (post-pandemic) - COVID led to significant shifts in customer behaviour. Matches make significant SKU purchasing decisions 12 months in advance and have strict pre-agreed sales windows. This leaves them exposed. It’s self-explanatory that the human buyer would struggle to make a sophisticated prediction of how to dovetail future demand with supply, especially in the middle of a pandemic.

Sector challenges (cost of living) - Today the online sector is going through a challenging time with questions also hanging over the future of Farfetch and Yoox Net-a-Porter. Selling luxury online is particularly tough given shoppers generally prefer to try on and see expensive products. Latest accounts show that Matches rely on 92% of their revenue from this channel.

Brand shift to DTC - Brands have been consciously moving away from Wholesale and ramping up DTC for their own sites. Despite the slow-down in Luxury in late 23, this DTC push seems to be working for them. For example, Ralph Lauren delivered its strongest growth in new customer acquisition and loyalty since the pandemic with 1.7 million new DTC consumers.

Matches’ Business Model and the case for AI

Matches has a Wholesale business model (see below graphic). Wholesalers (i.e. brands/suppliers) sell their products in bulk to a retailer at a discounted price. The retailer then sells on those products to consumers at a higher price.

It’s a model in structural decline. Even back in 2019 there was talk of this decline. Luxury brands were realising that the true value of selling directly to consumers is growing a database of customers and understanding exactly what they want in a shorter amount of time and being more reactive to those needs. The Wholesale model, where stock is purchased typically 12 months in advance, did not allow Matches much flexibility. All the more reason to invest in AI in ways that could enlighten Matches, make them more nimble with daily operational decisions and empower them when it came to commercial negotiations with suppliers.

Following the launch of their website (explosion of available data) in 2006 Matches had gathered customer and operational data for a decade and were sitting on a goldmine of potential for AI use cases.

Business Model Shift in 2022 (Post COVID) - competitors such as MyTheresa and Farfetch operate an e-concessions business model. Brands have full control over the display, content, and pricing of their products. It is therefore notable that in January 2022 Matches references a ‘strategic shift’ toward a concession model for some of the leading brands. They did this to reduce promotions whilst maintaining sell-through rates. 12 months later, they elaborate, by moving to a commission model that revenue had reduced but so have costs (no stock purchase).

The choice Matches faced in 2017 - hypothetically, we could imagine a scenario in 2017 when Matches had a choice:

1. Option 1 - Assume that their current model is the right one and then use data and AI to grow profitably.

2. Option 2 - Adopt a fundamentally different business model. E.g. an e-concessions model where suppliers place their products on Matches platform and pay Matches volume or margin-based payments.

What follows in this article assumes we follow Option 1. Which Matches did do until 2022.

Given this assumption, was there a specific opportunity in the profitable 17-18 period to ‘go big’ on AI at a time when the field was already taking-off? Farfetch, for example, had 630 data scientists and engineers by 2018.

Value Creation (AI) Levers

Lever 1 - Demand Forecasting (Sales & Cost of Goods Sold)

Commercial Metric - optimise sell-through rate, avoid lost sales

Data Science Metric - e.g. likelihood 1000 SKUs sell within 12 months time

Department used by - Purchasing

Clearly if you have a Wholesale business model then the ability to forecast the optimum SKU purchase 12 months out is crucial. It is noted that 12 months is a long window which will reduce forecast accuracy. The critical part is designing this around the human buying process to make the prediction trusted and explainable. E.g. what do you do if the buyer wanted to purchase 1000 SKUs and the algorithm recommends 500?

Demand Forecasting in highly volatile times (such as COVID) becomes much more complicated. Past sales patterns become somewhat irrelevant during a pandemic.

Lever 2 - Markdown Optimisation (Cost of Goods Sold)

Commercial Metric - reduce inventory, maximise profitability

Data Science Metric - e.g. predict likelihood of a product to sell at a specific price point

Department used by - Merchandising

Matches would have a window for planned and unplanned markdown. Using data such as sales, ERP and website analytics, a bespoke solution such as this, could have helped the Matches’ merchandisers move away from a manual gut-feel approach to a more sophisticated approach that considers future customer demand and price elasticity. Matches would have had to decide whether to build this solution themselves, go with a cheaper off-the-shelf vendor or a half-way house where they would build with an external provider.

Lever 3 - Acquisition (Sales)

Commercial Metric - increase number of new customers

Data Science Metric - e.g. predict likelihood of being a high value customer

Department used by - Marketing

Given that the top 3% of customers drive 35% of Matches sales, lookalike modelling could be used to search for clients with a similar profile in the external database to display targeted ads. Especially important for Matches to keep filling the funnel when even the wealthiest are reconsidering discretionary spend.

Lever 4 - Increase Items Sold (Sales)

Commercial Metric - Increase number of items sold per customer

Data Science Metric - e.g. predict likelihood of customer making a second purchase in 90 days

Department used by - Marketing

The reality of building a predictive propensity model is that there is quite a significant amount of change management required to move from, for example, fixed marketing rules sent every 6 months as email promotions to deploying a model and getting the existing team to work with it. The model would give Matches a ranked list of their customers. Each customer would have a decay curve with the likelihood of purchase decreasing through time. the commercial challenge concerns the who, when and what of marketing. Entice the customer to make a second purchase by sending a promotional offer at the right time. Crucially, doing this without cannibalising a sale that would have happened anyway.

A propensity model could have strategically helped Matches be much more precise with promotions and therefore move away from their steep discounting.

Lever 5 - Personalisation (Sales & Cost of Goods Sold)

Commercial Metric - Increase number of items sold per customer / increase sell-through rates

Data Science Metric - e.g. predict likelihood of customer purchasing product X over Y

Department used by - Marketing / Merchandising

This feels the most obvious lever Matches could have optimised. As stated in 2019, Matches had huge amounts of information to improve their offer and grow further. COVID changed what we were buying, when, where and how - it was a paradigm shift. In April 2020 retail sales were up 209% YoY. Although ML effectiveness was dampened during COVID, for many retailers ML-based personalisation was an essential response.

This was a core competence of Matchesfashion and should have been built in-house as early as possible. I suspect 2019 was their version 1.

It feels likely that this put them on the back foot when COVID hit, relative to the competition. Therefore not best positioned to capitalise on the shift to online.

Conclusion

Could Matches have ‘gone big’ on AI in 2017?

Matches faced industry and macro-economic headwinds (COVID, cost of living, supply chain disruptions). They had a good proposition as well as competitive advantage through proprietary customer data (gathered between 2006-2017). It is an interesting thought experiment to consider what might have happened if they had heavily invested in AI back in 2017.

I have blogged about the challenges of getting ROI from Data Science previously. It would be both overly-simplistic and naive to make the causality argument that AI would have been a panacea for Matches. However, there is a strong argument to make that it would have made them a bit more aerodynamic in the face of these headwinds.

Would Matches have needed an AI-Transformation?

There has been much talk of turnarounds at Matches and investments in back-end operations. The challenge Matches were grappling with was perhaps the consequence of scaling so quickly. By 2017 Matches had presence in 176 countries and 70 million site visits. Was investing in the ‘operations, technology and infrastructure’ in 2021 too late by then?

It is non-trivial to transform into what I would call an ‘AI-native’ culture. I experienced this at Amazon in 2015. On my first day I was introduced to a myriad of systems which were all connected to the backbone of the e-commerce operations. The ability to see real-time profitability at a SKU level. Phenomenal - data & AI running through the veins of the organisation!

I doubt whether Matches could, in the height of the pandemic, see real-time data. To give insights into a £250 trainer that is selling in Japan and make an assessment for what this means for other regions that are in different phases of the pandemic.

The crucial point being that the necessary infrastructure to do this requires a fundamental re-wiring of the organisation. Jeff Bezos built Amazon this way and was undoubtedly ahead of his time. He sent this memo to staff in 2002:

All teams will henceforth expose their data and functionality through service interfaces. Teams must communicate with each other through these interfaces. There will be no other form of inter-process communication allowed: no direct linking, no direct reads of another team's data store, no shared-memory model, no back-doors whatsoever. The only communication allowed is via service interface calls over the network.

So the question we are really grappling by ‘going big’ on AI becomes more nuanced. It becomes one of AI transformation … and 70% of transformations fail.

Perhaps a major (probably £5m-£10m) programme of work across people, process, technology to get Matches in the optimum position for advanced analytics and machine learning. This is about redesigning the operating model to become a more scientific, test-and-learn culture, which in turn allows commercial insights to jump out at leadership and impactful ML models to be deployed, measured and optimised rapidly showing clear ROI.

Doing great data science work in the absence of this ‘AI Transformation’ is analogous to asking my favourite football team to play in quicksand. It doesn’t just slow them down, it’s impossible. So how was competitor MyTheresa, also with a Wholesale business model, able to make a profit at a time Matches was making a £37m loss? There is good evidence that they were playing on a nicely manicured football pitch. Now they are the last major fashion marketplace left standing.

An AI Transformation is a devilishly complex thing to do with major considerations such as staff morale, keeping the commercial lights on and actually doing more harm than good. So it is quite possible that management decided the £29m profit earned in the 17-18 period was best spent on something else.

If this was the case, I can’t help but think that Matches should have attempted to move away from the Wholesale business model much earlier than 2021.